In this economy, everything is expensive, including insurance. It’s natural to look at your monthly budget and want to cut costs where you can. But no matter how financially strapped you are, you should never not have basic car insurance coverage. Driving uninsured is one of the most risky things you can do. On top of that, most states mandate that every driver has some level of bodily injury liability coverage and/or property damage liability coverage. This fact begs the question: is it illegal to not have car insurance in Louisiana? The short answer is yes. Below, our team of Baton Rouge car accident lawyers explain why it’s so important to protect yourself with basic car insurance coverage and what penalties you could face if you don’t.

If you or a loved one has suffered catastrophic injuries or wrongful death due to an uninsured driver, it’s crucial to seek out legal representation. Baton Rouge car accident lawyers at our law firm can help you make sure that all of your crash expenses get covered while you heal from your injuries. Call 225-343-1111 to schedule a free consultation at the Law Offices of Ossie Brown today.

Why is Car Insurance So Important?

Driving without insurance can be likened to driving without a seat belt on. It’s incredibly risky – physically, emotionally, and financially. At any moment, you could crash and suffer catastrophic injuries or even death. If you survive the accident, you’ll likely be facing thousands of dollars in medical bills, lost wages, car damage, and more because you don’t have the minimum amount of auto insurance coverage required by the state of Louisiana.

Put simply, auto insurance is incredibly important for every driver because the insurance takes care of most – or all – of the financial responsibility in the event of a car accident. Let’s be honest – because most Americans live paycheck to paycheck, we cannot afford to pay all of the damages associated with a crash.

Types of Car Insurance

Louisiana drivers are required to have basic liability insurance, but there are plenty of other coverage options you can add on for the sake of extra protection on the roads.

Liability Insurance

Liability insurance is the most basic auto insurance that all drivers should have. It protects drivers from taking full financial responsibility in the event that they cause an accident. Liability coverage can provide compensation for all medical expenses and vehicle repairs.

Collision Coverage

Collision insurance can pay for all expenses associated with crashing into another car or a stationary object, such as a deer. So if you need to repair or replace your car after any kind of collision, this type of insurance will cover it.

Comprehensive Coverage

Comprehensive insurance covers all non-accident-related vehicle damage from fires, vandalism, falling objects, theft, weather-related damage, etc.

Gap Insurance

Gap insurance can help drivers pay off their car loan if their car is stolen or totaled, and the remaining balance on the loan equals more than the car’s value.

Medical Payments Coverage

Basic auto insurance covers some (or all) medical bills after an accident. But if you or a passenger suffered catastrophic injuries in an accident, this basic coverage may not be enough to cover all medical debt. That’s where additional medical payments coverage comes in. This type of insurance can help pay for your passenger’s medical debt after an accident, no matter who caused it.

Rental Car Coverage

Occasional car repairs are a part of life, regardless of whether or not the repairs are connected to a car accident. Extensive repairs can leave your car in the shop for multiple days or even weeks, leaving you with two options: carpooling or getting a rental car. Carpooling is often a hassle for everyone involved, and rental cars are expensive. If you have rental car coverage though, you could rent a car at little to no cost.

Underinsured or Uninsured Motorist Insurance

If an underinsured or uninsured driver crashes into you, you’re out of luck when it comes to coverage for medical debt and vehicle repairs. That is, unless you have uninsured/underinsured motorist (UIM) coverage. This type of insurance will cover everything that the other driver was supposed to cover with their own liability coverage. So, it’s definitely not a bad idea to have.

Personal Injury Protection Coverage

Personal injury protection (PIP) insurance – also known as “no-fault insurance” – covers medical bills, lost wages, and other expenses after an accident, no matter who is at fault.

Louisiana Car Insurance Laws

Driving without insurance is incredibly risky, yet more than 12% of Americans did just that in 2019, according to a recent study by the Insurance Research Council (IRC). Below, we discuss how auto insurance works after an accident and the minimum amount of insurance that all Louisiana drivers must have.

Is Louisiana an At-Fault State?

First thing’s first: it’s important to understand basic fault laws in our state.

Louisiana is an at-fault state, meaning that the at-fault party’s insurance company must pay for all damages that all parties suffered in the accident (up to coverage limits). On the other hand, no fault states mandate that all drivers file a claim with their insurance company, no matter who caused the accident.

Is It Illegal to Not Have Car Insurance in Louisiana?

Yes. Laws in nearly every state – including Louisiana – state that having a basic amount of car insurance coverage is mandatory.

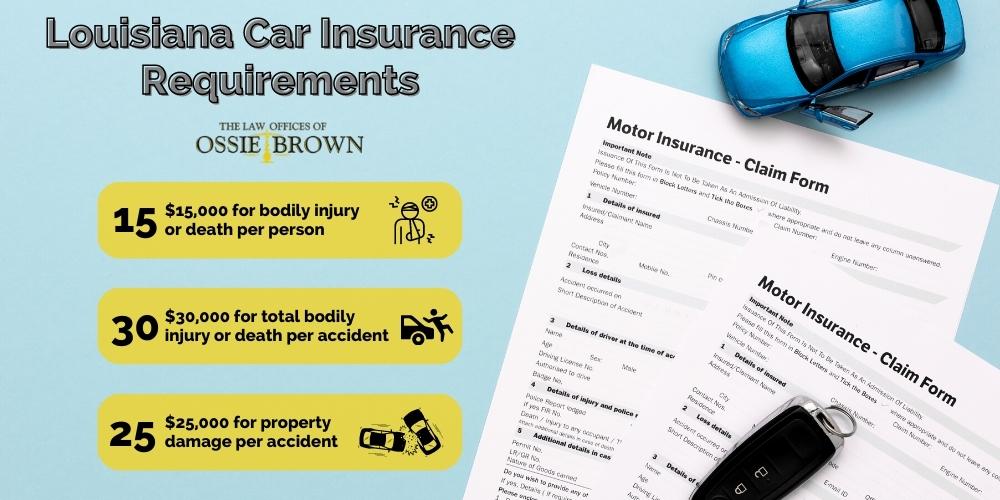

Louisiana Car Insurance Minimum Requirements

Listed below is the minimum level of car insurance required by Louisiana law:

- $15,000 for bodily injury and/or death per person in an accident caused by the insured driver.

- $30,000 for total bodily injury and/or death per accident in an accident caused by the insured driver.

- $25,000 for property damage liability coverage in an accident caused by the insured driver.

This basic car insurance coverage will cover your medical bills and vehicle damage as well as the medical bills and vehicle damage of other drivers, pedestrians, bicyclists, etc. involved in the accident. While the minimum level of insurance does cover a lot, it doesn’t cover everything, which is why it’s always a good idea to add on additional policies.

Additionally, this insurance will only cover damages up to the policy limits. So if you get into a major semi-truck accident, for example, and you and your passenger suffer catastrophic injuries, the insurance probably won’t be able to cover everything. At that point, the rest of the costs will come out of your pocket.

If you can’t afford these costs, you can always file a personal injury lawsuit against the semi-truck driver, especially if they are at fault. Our Baton Rouge truck accident attorneys can help with this.

What Happens if I Drive Without Car Insurance in Louisiana?

You cannot legally drive without proof of insurance in the state of Louisiana. Technically, you can get away with it until you’re caught and pulled over by law enforcement, but this is not a good idea for all the reasons we explained previously.

If you get pulled over by a police officer for any reason, they will likely ask for you to provide proof of insurance and vehicle registration. If you don’t have an insurance card or vehicle registration documents, you could face some serious penalties, including significant fines, suspension of driving privileges, and even jail time.

Penalties for No Car Insurance in Louisiana

If you’re caught driving without insurance, you could face the following legal penalties:

- $500 to $1,000 in fines,

- Suspension of driving privileges,

- Vehicle impoundment,

- Revoked vehicle registration,

- Or canceled license plates.

Louisiana also has a “No Pay, No Play” law (RS 32:866) that’s designed to further punish uninsured drivers. This law states that if you’re uninsured and get into a car accident, you have to pay the first $15,000 in bodily injury liability and the first $25,000 in property damage, even if the other driver is technically at fault in the accident.

On top of the damages you probably suffered as a result of the accident, this penalty is enough to catapult you into years of crippling debt. That’s why it pays to have the minimum bodily injury and property damage liability coverage – literally.

Call Baton Rouge Car Accident Lawyers at The Law Offices of Ossie Brown Today

If you or a loved one suffered major injuries or death in a car accident with an uninsured driver, it’s crucial to reach out to an experienced car accident lawyer at our law firm. Our Baton Rouge uninsured motorist lawyers have been helping our injured clients obtain justice and financial compensation for their suffering since 1984. We can do the same for you. Call 225-343-1111 to schedule a free consultation with our Baton Rouge personal injury attorneys.