In the United States, the issue of uninsured and underinsured drivers is a widespread problem, posing significant risks on the roads. In response to this challenge, Louisiana enforced the “No Pay, No Play” law, a unique legislative measure aimed at addressing the repercussions of accidents involving uninsured motorists. This law essentially restricts uninsured drivers from recovering certain types of damages – such as the first fifteen thousand dollars for personal injuries and the first twenty-five thousand dollars for property damage – if they are involved in a motor vehicle accident regardless of who is at fault. This law aims to incentivize drivers to invest in the minimum amount of liability insurance as required by state law. Even still, plenty of Louisianans drive around uninsured and end up causing accidents.

For victims of car accidents involving at-fault, uninsured drivers, Baton Rouge uninsured motorist lawyers at the Law Offices of Ossie Brown offer specialized legal assistance. Our experienced legal team can navigate the complexities of the Louisiana No Pay, No Play law, striving to ensure that accident victims receive the justice and compensation they rightfully deserve. Call 225-343-1111 to schedule a free consultation at our law firm today.

How Many U.S. Drivers Are Uninsured?

It might seem unlikely that many people would drive without insurance, especially since insurance is required to even drive a used car off a dealership lot. However, the reality is that a significant number of drivers are not. In fact, about 1 in 8 motorists in the United States, which equates to approximately 28 million people, are driving without car insurance according to the Insurance Information Institute (III). Specifically for our state, an estimated 11-12% of Louisiana drivers are uninsured. This means that the likelihood of encountering an uninsured car on the road is higher than one might think.

Moreover, there’s an issue with underinsured motorists. These are drivers who do have auto accident insurance, but their coverage is insufficient to cover the full extent of damages they might cause in an accident. In such cases, if you seek compensation for medical bills, lost income, and vehicle repair costs from a driver responsible for an accident, their limited underinsured motorist coverage might fall short of covering your expenses.

Is It Illegal To Not Have Car Insurance in Louisiana?

In Louisiana, as in most states, driving without auto accident insurance is illegal. Our state mandates certain minimum requirements for auto insurance to ensure that all drivers can cover the costs associated with property damages or bodily injury damages in the event of an accident.

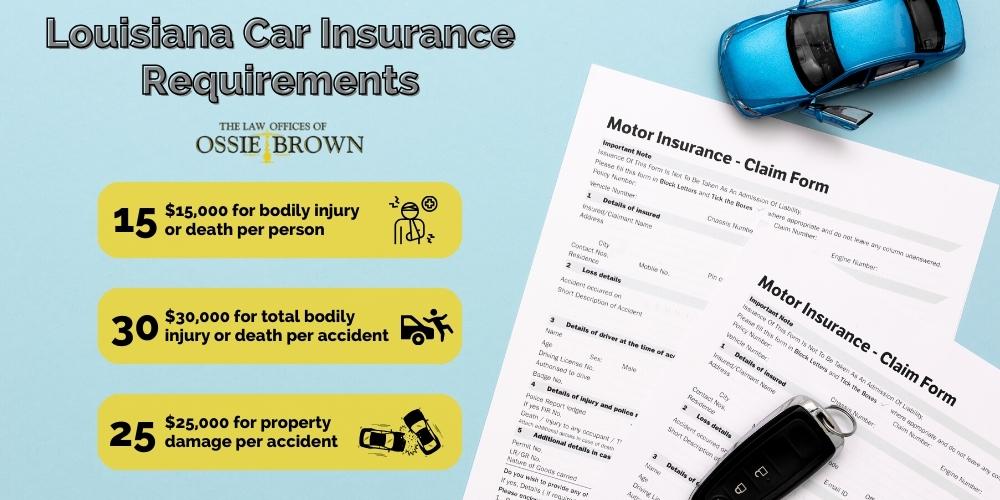

Louisiana Car Insurance Company Minimum Requirements

You may be wondering: is it illegal to not have car insurance in Louisiana? The answer is yes. Listed below is the minimum amount of auto accident insurance mandated by Louisiana law:

- $15,000 for death or bodily injury coverage per person in an accident caused by the insured driver.

- $30,000 for death or bodily injury coverage per accident when caused by the insured driver.

- $25,000 for property damage coverage in an accident caused by the insured driver.

This fundamental level of car insurance is designed to cover medical expenses and vehicle repairs for you, as well as other parties involved in the accident such as other drivers, pedestrians, and bicyclists. However, while this minimum coverage addresses many scenarios, it doesn’t encompass all possibilities, which is why most auto insurance providers recommend investing in other types of insurance policies as well, such as uninsured motorist coverage, comprehensive coverage, and even rental car coverage. Your insurance company can help you choose the best types of policies for your type of car, lifestyle, and general wishes.

It’s important to note that these insurance policies have limits to their coverage. In the event of a catastrophic accident, such as one involving a semi-truck, the basic liability coverage may be insufficient to cover all the damages. In cases like this, any costs exceeding the policy limits will come out of your own pocket. If these costs are unaffordable, you have the option to pursue a personal injury lawsuit against the driver of the semi-truck, especially if they were at fault.

What Happens if You Drive Without Auto Insurance in Louisiana?

In Louisiana, driving without valid proof of insurance is illegal. While it’s possible to drive without it until law enforcement catches you, this approach is highly discouraged because you can face serious penalties.

When stopped by a police officer for any reason, they will typically request proof of insurance along with your vehicle registration. Failing to present an insurance company card or registration documents can lead to severe consequences such as hefty fines, suspension of your driving privileges, and potentially even incarceration.

Penalties For Being Uninsured or Underinsured in Louisiana

If you get caught driving without the minimum insurance requirements in Louisiana, you can face the following legal repercussions:

- Fines ranging from $500 to $1,000,

- Suspension of your driving license,

- Impoundment of your vehicle,

- Revocation of your vehicle’s registration,

- Cancellation of your license plates.

Louisiana No Pay, No Play Law

Did you know: Louisiana is the second most expensive state for auto accident insurance, partially because there are so many people driving around without insurance coverage. In order to address this problem, Louisiana passed the No Pay, No Play Law (RS 32:866) in 2011 which encourages drivers to invest in liability coverage, and also penalizes them if they don’t.

More specifically, the Louisiana No Pay, No Play law prevents drivers without the minimum required auto insurance from claiming the first $15,000 for personal injuries and the first $25,000 for property damage in an accident, regardless of who is at fault. In other words, uninsured drivers have to pay the first $15,000 of medical costs and the first $25,000 of property damages out of their own pocket.

For drivers in Louisiana, understanding this law is crucial, as it fundamentally alters the legal landscape for an uninsured motor vehicle involved in an accident. It emphasizes the importance of adhering to state insurance regulations and underscores the potential legal and financial consequences of non-compliance.

Exceptions to No Pay, No Play Louisiana

In Louisiana’s “No Pay, No Play” law, certain exceptions allow uninsured drivers to claim damages under specific circumstances. These exceptions are critical to understanding the full scope of the law:

- Drunk Driving: If the insured driver is found to be under the influence of alcohol or drugs at the time of the accident, then the uninsured motorist can claim damages. Be sure to contact a Baton Rouge DUI lawyer for more information.

- Intentional Acts: In cases where the accident was caused intentionally by the insured driver, the uninsured driver is not barred from seeking compensation.

- Hit And Runs: If an insured driver causes a motor vehicle accident with an uninsured driver and then flees the scene, the No Pay, No Play Law no longer applies. Baton Rouge hit and run attorneys can help victims learn more about their legal options.

- Legally Parked Cars: The law does not apply if the uninsured motorist’s vehicle was legally parked at the time of the accident.

- Out-of-State Drivers: Drivers with vehicles registered in another state that do not require insurance are exempt from this law while driving in Louisiana.

- Passenger Claims: The No Pay, No Play Law also doesn’t apply to a passenger’s claim unless they co-own the uninsured car.

These exceptions are designed to ensure fairness and justice in situations where the uninsured driver might otherwise be unfairly penalized, especially in instances where the insured driver’s conduct significantly contributes to the accident.

If you’re confused about whether these exceptions apply to your situation, be sure to consult with a Baton Rouge car accident lawyer at the Law Offices of Ossie Brown.

Can You Sue an Uninsured Motorist After They Have Caused an Accident?

In Louisiana, the question of whether you can sue an uninsured motorist after they have caused an accident is complex and largely dependent on specific circumstances. While the state’s No Pay, No Play law restricts uninsured drivers from claiming certain types of bodily injury damages and property damages from the applicable insurance policy, it does not inherently prevent someone from suing an uninsured driver at fault. In such cases, the plaintiff must consider the practicality and potential outcomes of the lawsuit against the other driver.

Given that uninsured motorists may not have the financial resources to cover the damages, pursuing legal action could be challenging and may not always result in financial compensation. However, there are legal avenues available for seeking justice and compensation, and each case may present unique elements that could influence the decision to litigate. Consulting with a knowledgeable car accident attorney is crucial for understanding your rights and the viability of a lawsuit in these situations.

Car Accident Damages

In Louisiana, victims of car accidents have the right to claim various types of damages through a lawsuit. These personal injury damages are designed to compensate for the losses and suffering caused by the accident:

- Medical Expenses: Compensation for all medical costs, including hospital bills, medications, rehabilitation, and any future medical care related to the accident.

- Lost Wages: Reimbursement for income lost due to the inability to work following the accident, as well as potential future earnings lost due to long-term injury impacts.

- Pain and Suffering: Monetary compensation for the physical pain and emotional distress endured as a result of the accident.

- Property Damage: Covers the cost of repairing or replacing your vehicle and any other personal property damaged in the accident.

- Loss of Enjoyment of Life: Compensation for the loss of enjoyment in daily activities and hobbies due to injuries sustained.

- Punitive Damages: In some cases, where the at-fault driver’s actions were particularly reckless or egregious, punitive damages may be awarded as a means to punish the wrongdoer and deter similar behavior.

A Baton Rouge personal injury attorney at the Law Offices of Ossie Brown can help victims obtain justice and recover damages from the at-fault driver.

Call a Baton Rouge Uninsured Motorist Lawyer at the Law Offices of Ossie Brown Today

If you’ve been involved in a car accident with an uninsured motorist in Baton Rouge, it’s essential to seek the expertise of a specialized car accident lawyer. The Law Offices of Ossie Brown offers top-notch legal representation for those who are hit by uninsured motorists.

Our team of experienced uninsured motorist lawyers is well-versed in navigating the complexities of Louisiana’s auto insurance laws as well as the No Pay, No Play statute. By choosing our legal team, you can trust that you’ll obtain justice and fair compensation from the at-fault driver. Additionally, we’ll make sure that your rights are protected and your case is handled with the utmost care and professionalism.

We are ready to begin an attorney-client relationship with you today. Call the Law Offices of Ossie Brown today at 225-343-1111 to schedule a free consultation and take the first step towards securing the compensation you deserve.